Request for consultancy to Conduct financial needs assessme...

Terms of Reference (ToR)

Subject: Request for consultancy to Conduct financial needs assessments.

Date of issuance: 4-4-2019

Due Date for submission of offers: 11-4-2019

-

Purpose of the consultancy

The main objective of the assignment is to develop a needs assessment study and gather data from around 1000 women entrepreneurs residing in the target areas (Nablus, Ramallah, Jenin, Bethlehem and Hebron), with new or existing businesses from a range of socioeconomic backgrounds, including those most marginalized and vulnerable, in order to determine their training needs.

This assignment is part of supporting sustainable and gender-responsive financial solutions within the framework of the Project entitled “Generating Revenue Opportunities for Women and Youth in the West Bank” (GROW), which is funded by the Government of Canada and implemented by CowaterSogema, Palestinian Businesswomen’s Association (Asala) and Near East Foundation (NEF). The Project aims at enhancing the economic empowerment and increasing prosperity for low-income women and youth in the West Bank.

-

Background

According to the World Bank, “Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way”. Furthermore, the World Bank, international development agencies, and policy makers consider financial inclusion a key enabler to reducing poverty and boosting prosperity. Financial inclusion has emerged as a critical development challenge and is a hot topic among policymakers, development practitioners and the private sector. In fact, the foundation of financial inclusion is woven into seven of the 17 Sustainable Development Goals (SDGs).

Findings of the Palestinian Financial Inclusion Survey confirm that women fare lowest in financial literacy/awareness, access, and use indicators of the different financial services and products. This applies to women in GROW’s selected sectors for intervention who suffer from exclusion from basic financial products and services. This exclusion affects a wide variety of women; educated and less educated; those currently engaged in traditional types of income generating activities; educated women who are currently engaged in or have the potential to engage in innovative types of self-employment jobs. All of these groups of women remain unable to access and benefit from different saving, credit and other financial services offered by Palestinian financial service providers.

The Palestinian micro and small-business female entrepreneurs, especially those operating in remote areas under no organizational framework, have a relatively low capacity and limited awareness of business management, marketing and environmentally friendly practices and methods. In addition, many women entrepreneurs have financial challenges in covering their businesses and financial expenses, especially when they cannot sell their products to market due to the lack of access to finance and market connections. In addition, the Palestinian private sector is not capable of equipping women entrepreneurs with the business capacities to meet their needs, nor are women prioritized by many non-governmental organizations due to their focus on different capacity building areas. These women confront myriad barriers in accessing economic and financial opportunities, securing socioeconomic rights, and achieving equal economic participation with men. The majority of women entrepreneurs whom Asala has worked with over the years in the fields of financial literacy and entrepreneurship indicate that sociocultural constraints often cause women to abandon their project ideas and reinforce the notion that women should be mainly occupied with reproductive tasks within the home. Another major challenge women entrepreneurs encounter is the lack of efficient financial literacy, business management, the absence of business and marketing plans as well as limited access to finance and markets. These constraints hinder women from thriving in such a competitive and male-occupied market place.

Women are more economically empowered if they have sufficient awareness of and access to financial resources, such as grants and loans, and are equipped with financial literacy and business management skills supporting their economic participation and growth. Increasing the number of women entrepreneurs in the West Bank and providing them with the necessary resources, skills, tools and support not only contributes to overall economic growth, but also to poverty alleviation, women's economic empowerment, and to positive changes in sociocultural dynamics between women and men in the West Bank.

GROW will build on the momentum created as a result of the official endorsement of the first ever National Financial Inclusion Strategy in 2018, and the creation of the National Financial Inclusion Committee which is comprised from relevant ministries such as Ministry of Education and Higher Education (MoEHE), Ministry of Finance (MoF), Ministry of National Economicy (MoNE), Ministry of Social Development (MoSD), Ministry of Women’s Affairs(MoWA), and other relevant organizations such as Association of Banks, Network of Microfinance Institutions (Sharaka), Federation of Chambers of Commerce (CoC), Palestinian Capital Market Authority (PCMA) and other financial and economic experts. GROW will work with the above mentioned market actors/potential partners to facilitate the development and delivery of financial literacy training and awareness raising sessions in close coordination with the PMA to ensure aligning with the financial inclusion strategy objectives and priorities..

In line with GROW project’s logic model, particularly, the immediate outcome 1110 Increased access to a supportive environment for women-led MSMEs and cooperatives, and Output 1112: Sustainable and gender-responsive financial solutions identified/ supported for women-led MSMEs/cooperatives. GROW project in partnership with ASALA (Businesswomen’s Association) would like to implement financial literacy training and awareness raising sessions which will be tailored to the needs of women beneficiaries. As a result, 1000 women will be benefit from the financial literacy training and awareness raising sessions.

-

Scope of work

The consultant is expected to support Asala in conducting a financial needs assessment for 1000 women beneficiaries residing in the target areas (Nablus, Ramallah, Jenin, Tulkarem, Salfit, Bethlehem and Hebron) with new or existing businesses, particularly MSMEs from a range of socioeconomic backgrounds, including those most marginalized and vulnerable, in order to determine their financial training needs. The needs assessment will be used to design a gendered financial training program that corresponds to the identified female respondents (MSMEs). The process will include the development of the needs assessment surveys, collection of the data, and analysis of the results and findings, designing qualitative tools to be used with female led MSMEs and other relevant stakeholders. The findings of the financial needs’ assessment will serve as the foundation of the gender-responsive training development to determine what training areas need to be covered, assess women’s financial management skills, identify financial-related gaps or problems and customize the training content and curriculum to women’s needs.

The consultant will be required to undertake the following:

- Submit an Inception report detailing the understanding/ interpretation of the TOR; the methodology of carrying out the assignment, work plan and implementation schedule by April 21, 2019

- Design the qualitative and quantitative needs assessment tools in order to assess women’s financial management skills and identify financial-related gaps or problems By April 24, 2019, This includes finding the level of women awareness regarding; the financial statements, banks procedures and requirements and how to deal with banks, loans literacy, cash flow and cash projections, income tax and taxation issues, marketing and internet.

- General features and issues through conducting focus groups discussions and discuss the issues relevant to financial literacy. The consultant will come up with the relevant financial information as mentioned above.

- Conduct specific field visits to the targeted areas to undertake the financial training needs assessment. In addition to meetings and interviews with relevant stakeholder such as the PMA, Sharaka Network and member financial service providers.

- Analyse the results and the findings drawn from the women’s responses. The findings of the needs assessment will serve as the foundation of the gender-responsive training development to determine what training areas need to be covered.

- Suggest a customized- financial training plan, methodologies, training topics in line with the women beneficiaries’ needs, categorized in the targeted areas above.

-

Deliverables and expected output

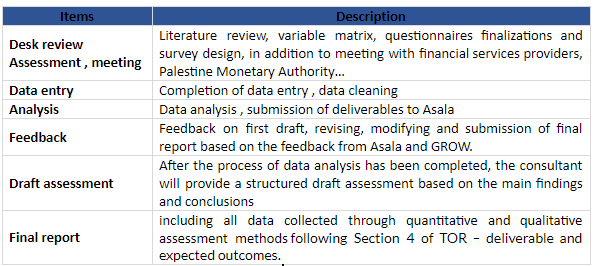

After the data collection has been completed, the consultant is expected to deliver the following:

- Produce a well-written and comprehensive final draft report (in English and Arabic) including all data collected through quantitative and qualitative assessment methods, challenges, recommendations and suggestions for the financial training curricula , annexes and any relevant documents... (Expected number of pages from 40 to 50 pages).

- Analyse responses to applied questionnaire through data entry and the use of statistical software.

- Create and design Infographic of most important findings

- Identify key concepts and methodologies on financial training

- Suggest a customized- financial training plan, methodologies, training topics in line with the women beneficiaries’ needs, categorized in the targeted areas above

- Facilitate a presentation workshop to disseminate the findings among key stakeholders.

- Design an infographic to present the main findings.

-

Schedule of Specification

-

Timeframe of the consultancy

Final version of the financial assessment to be submitted on 29-4-2019

-

Reporting

The consultant/firm is required to work closely with Asala and GROW team.

-

Requirements

- For companies: Registration certificate, source of deduction and tax invoice.

- Freelancer: Copy of ID

- For Both: CVs of the team who will implement the assignment

-

Eligible consulting firms or individuals

Eligible consulting firms must meet the following minimum requirements:

- 5 years of experience in developing financial need assessment surveys, particularly in financial literacy

- Experience in research, methodology development, beneficiary impact assessments, gender – related consultancies

- Ability to arrange and manage all logistics related to the implementation of the assignment.

-

Contract terms of payment (after the evaluation)

The final payment shall be made after complete delivery of the services and acceptance of work.

- Proposal Structure:

Interested Consultants should submit:

- Technical Proposal

Explaining your experience in similar assignments, technical approach and methodology of work, team structure (for companies), C.V of consultant/ team members.

- Financial Proposal

Your price offer should be in USD including VAT.

Interested Consultants should send their proposal and Price offer to the Palestinian Businesswomen’s Association ASALA Office located Albireh – khalaf trading tower – 2nd floor in sealed and signed envelopes no longer than Thursday April 11th, 2019 by 3:00 PM.