Media Campaign Consultancy

Developing Equitable Agricultural Production and Market Systems for Resilience Economic Development in the Occupied Palestinian Territory

media campaign

Background & Introduction:

In 2015, drawing upon its demonstrable experience in the agricultural sector, both globally and within the occupied Palestinian territory (oPt), Oxfam developed a program titled “Developing Equitable Agricultural Production and Market Systems for Resilient Economic Development in the occupied Palestinian territory” with the aim to contribute to resilient and equitable agricultural growth benefiting small-scale women and men producers in the oPt. Its specific objective is to increase the resilience and income of small-scale women and men producers through improved production and market systems in the West Bank, including East Jerusalem, and the Gaza Strip. Four inter-related outcomes will be targeted: (1) Small-scale agricultural farming systems are more productive, sustainable, and responsive to market demand in the selected commodity value chains, through a market system approach. (2) Market systems in selected VCs are efficient, transparent, inclusive and rewarding for women and men small-scale producers. (3) Enabling policies and market regulations are more inclusive and better promote the interests of small-scale producers; and, GoI violations of IHL and IHRL are challenged. (4) Local partners and relevant sector organizations can practice market systems approach for pro-poor and resilient agriculture development.

CONTEXT AND BACKGROUND

within the frame of the project “Developing Equitable Agricultural and Market Systems for Resilient Economic Development in the occupied Palestinian Territory”, Palestinian Farmers Union worked in Partnership with Oxfam on the project agricultural polices specific outcomes namely:” improving Specific policies and practices in the agricultural sector according to international best practices” and “The value added TAX refund system is activated for livestock producers.” As the VAT refund for agriculture inputs remained active for plant agriculture and cancelled for livestock agriculture since 2013.

During 2017 PFU worked on the implementation of a series of activities requesting and demanding the government to activate VAT refund. PFU Held several meetings with MoA, MoF and Palestinian Agricultural Disaster Risk Reduction Fund aiming at Designing a simple and readable manuals for natural disasters compensations and Tax refund. PFU also held 3 awareness campaigns in Tulkarem, Jenin and Tubas to encourage farmers to open VAT and present tax invoices to the government to avoid tax evasion and protect the Palestinian National economy. In addition to that PFU hired a specialized consultant to conduct a technical study on tax refund for livestock sector. PFU also organized A big protestation for farmers and farmers representation bodies was held at the 12th of September in front of the Cabinet with the participation of more than 450 farmers. The results of this protest is the release of 31 million of Shekels as VAT refund for the benefit of 700 farmers across the West Bank, held a series of meetings with the ministries of agriculture and finance to solve the outstanding problems including Stop demanding farmers pay income tax retroactively, and claiming the MoF of rapid compensation. In addition to that, PFU conducted two semi-annual lobby meetings in Tulkarem and Tubas which were attended by Governors of the two districts, MoA, MoF and senior level representation from district decision makers. The aim of the two meetings was to obtain support of farmers’ rights to activate tax refund for livestock farmers. As a result a petition was prepared and signed.

By the end of the year 2017, PFU received promises from the MOF and MoA to provide written adoption of tax refund. However the process within the two ministries is slow and requires addition pressure during 2018 intervention. Therefore PFU proposes to conduct a continued campaign during first part of 2018 to pressure the two ministries to adopt the tax refund for livestock farmers. The main idea is to benefit from the momentum created during the last 2 months of 2017 and continue pressure during 2018 through creating a wide pressuring public opinion through media, social media, workshops, events etc.

During 2018 PFU Could reach an agreement with MoA and MoF to activate tax refund for livestock farmers at 50/50%. This achievement was communicated to PFU during the last meeting with the Minister of Agriculture in June 2018. Later on July, 2018 a decree was issued by the President regarding the tax refund for livestock breeders at a 50/50% rate. As 50% will be refunded to livestock breeders, whereas the other 50% will be given to the PADRRIF and the MoF equally at 25% each. In principle this is a great achievement on tax refund policy change that would reflect positively on pumping funds to PADRRIF to make it better functional as well as enable livestock farmers to open tax files and generate more income from tax refund. In addition this development will reflect on the package of given by government mainly on agricultural insurance and compensation.

The Palestinian Farmers’ Union (PFU) is working on a media campaign to reach the maximum number of farmers to encourage them to demand their rights in VAT refund.

PURPOSE OF PRODUCING THE SPOT

The purpose of the media campaign is to empower farmers about tax refund and how to open tax files which gradually will grant more benefits for farmers such as benefitting from PADRRIF and PACI funds.

MEDIA CAMPAIGN OBJECTIVES

- The overall objective of the assignment is to conduct a media campaign in order to reach maximum number of farmers to encourage them to demand their rights in VAT refund.

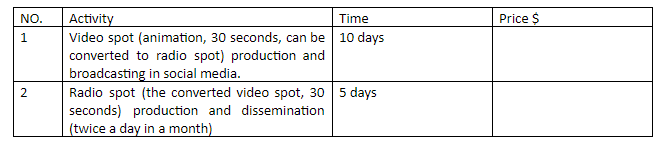

- The production of the following:

- Video and Radio spots aim at raising farmers’ awareness regarding tax refund including the vat law, tax filling guidance.

TARGETED AUDIENCE:

- Final Beneficiaries: The direct beneficiaries of the action will be the vulnerable farmers who will benefit from the action through raising their awareness regarding VAT refund.

The main output of this work is to direct, edit and produces a 30 seconds video and radio spots reflecting the messages that raise farmers’ awareness regarding the tax refund. The outputs should be suitable for public screening and posting on digital media.

DELIVERABLES

- A 30 seconds video spot aim at raise farmers’ awareness regarding tax refund including the vat law, tax filling guidance.

- A 30 seconds radio spot aim at raise farmers’ awareness regarding tax refund including the vat law, tax filling guidance.

- All versions must be suitable for - Broadcast on TV channels; - Conference presentations on large screens; - Internet and mobile internet use through platforms such as website, YouTube and Facebook.

- Web optimized version.

METHODOLOGY

The following methodology will be applied in carrying out the media campaign as outlined:

- Meetings with PFU, to collect data and the shape of the radio and Video spots we want.

- Submit a storyboard and script for the video and radio spots to PFU for approval before start developing.

- Present one draft of both video and radio spots to PFU for approval and comments

- Present a complete 30 seconds radio spots.

- Present a complete 30 seconds video spots.

TIMEFRAME

The media campaign will have 15 working days to undertake the desk and field work and submit the last draft of the spots. The draft will be reviewed by PFU staff and feedback will be provided to the firm. The final draft should be submitted maximum 5 days after receiving feedback on the first draft.

MEDIA CAMPAIGN MANAGEMENT

The commissioning manager of the media campaign will be PFU Media and Communication coordinator. The firm will submit a plan including detailed methodology, distribution plan, storyboard and script for the media campaign to PFU for approval before filming. PFU Media and Communication Coordinator will provide necessary technical support for the development of the methodology and tools and review the spot draft. The firm will submit the draft to PFU Media and Communication Coordinator and after receiving comments on the draft will submit the final documentary as per the agreed time plan.

REQUIRED SKILLS

The position requires the firm to have:

-

Professional expertise in making spots, journalism or equivalent combination of relevant experience

-

Ability to produce concept storyboards/peg boards for internal coordination purposes

-

Ability to do post-production work (English translations, subtitles, editing)

-

Experience working with NGOs on producing videos/communication materials

-

Excellent writing and storytelling expertise

-

Excellent coordination, organizational/management and communication skills

-

Ability to travel and work independently and under tight time constraints

-

Capacity to provide necessary filming/production equipment

9 Distribution channels

Financial Proposal

- Prices are valid for 30 days

-The submitted offers should be in US Dollars excluding VAT. The tendered should be able to issue Payment request in addition to deduction at source certificate (شهادة خصم مصدر) or will deduct a percentage of the final payment according to Palestinian Taxation department & laws.

- Prices include all types of expenses such as transportations, per -diem ,calls ,...

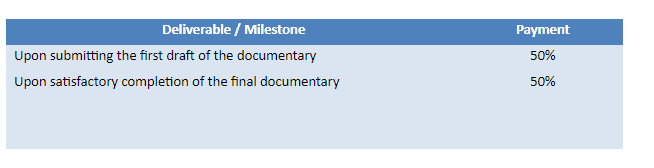

The remuneration is to be paid based on the following milestones:

- Acceptance: Award of a proposal does not imply acceptance of its terms and conditions. PFU reserves the option to negotiate on the final terms and conditions.

Please submit the proposal (technical & financial offer) and requested documents by in sealed envelope by 29/8/2019 addressing to: PFU /Ramallah, El Bireh, 12 Hollanda Street, Near Representative Office of Netherlands; feel free to contact PFU’s Media and Communication Coordinator Amjaad Abualia at PFU’s head office: Telephone 02-240 0792.